In August 2018 Weybrook Business Brokers conducted research with business buyers to determine how they value businesses, we haven’t updated the research but the findings remain intact in mid-2019.

There is an old cliché that states that;” your business is worth what a buyer is prepared to pay for it”, whilst this is true, most sellers need a realistic valuation range before making a decision to put their business on the market.

A common mistake is overvaluing a business and therefore deterring potential buyers. If the buyer is going to the financial markets to borrow money to fund an acquisition, then the business must generate sufficient profit top service that debt and give a return on the investment on top.

Commonly we see offers staged over a number of years where the buyer uses the cash generated buy the vendor at agreed timescales. These deals are not popular with sellers but in a market where financing is tough, sometimes they are the only deals around.

The message is clear – profit is a key driver of positive valuation, so if you want to sell your business at a good price, being able to demonstrate a trend for profitable growth is a key priority.

Our 2018 findings are shared below.

Valuation model

Two-thirds of respondents use a multiple of EBITDA (earnings before interest, tax depreciation and amortisation) a quarter use a multiple of PE (price earnings ratio) and the remainder use DCF (discounted cash flow) as their valuation models. A minority of buyers see tax as a legitimate cost and therefore use PE as their valuation tool.

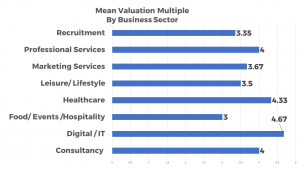

Valuation multiple by sector

The mean valuation multiple currently being paid by sector is shown below:

The highest multiples are being paid in the Digital / IT sectors with the lowest in Food/ Events / Hospitality but buyers do point to future value/cash flow being the key driver of how high the multiple is. The multiples paid by valuers using PE as a valuation tool were up to 1 point higher than those used for EBITDA. The multiple for “other sectors” came to 4.

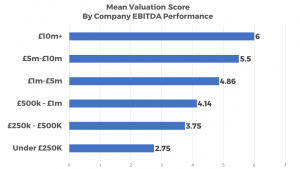

Valuation multiple by profitability / EBITDA

The trend for higher multiples being paid for more profitable businesses is born out by the mean scores below:

Buyers will typically be happy to pay more for companies with real profit growth prospects.

How much will buyers pay on completion of the sale?

The answer here varies between 0 and 80%, with the mean score being 49%. This is not what most sellers want to hear, as earn outs have a bad press, with the fear being that new owners will manipulate future profitability in their favour. However, the research suggests that sellers will have to be realistic.

How long will the staged completion payments take?

With only half the fee being paid on completion, the full amount is likely to be paid anywhere between 1 and 4 years after completion.

• 25% will complete after 1 year

• 25% will complete after 2 years

• 37.5% will complete after 3 years

• The remainder are likely to complete within 4 years

2019 trends observed

In 2019 we have observed a number of buyers who offering a multiple of three to four times net profit (+ cash on some occasions ) as a valuation tool.

So what are the conclusions?

The majority of buyers use a multiple of EBITDA to value a business they are looking to purchase. The multiples do vary a little by sector and will increase for businesses that generate higher profit levels. The multiples typically start at 2.75 for businesses generating an EBITDA less than £250k and rise to 6 for businesses generating over £10m. This research confirms that buyers are currently paying conservative prices in the current market. The majority of offers coming in at the moment are for multiples under 3 times EBITDA.

The article was updated in May 2019 and the research was conducted in August 2018 and the survey was sent to over 50 regular business buyers. The response rate gives us the confidence to publish the results, showing a good snapshot of current business buyer intentions, but the survey cannot be said to be a definitive UK Market survey.